How To Fix A Botched RMD To Avoid The 50% Penalty

www.kitces.com

www.kitces.com penalty rmd explanation

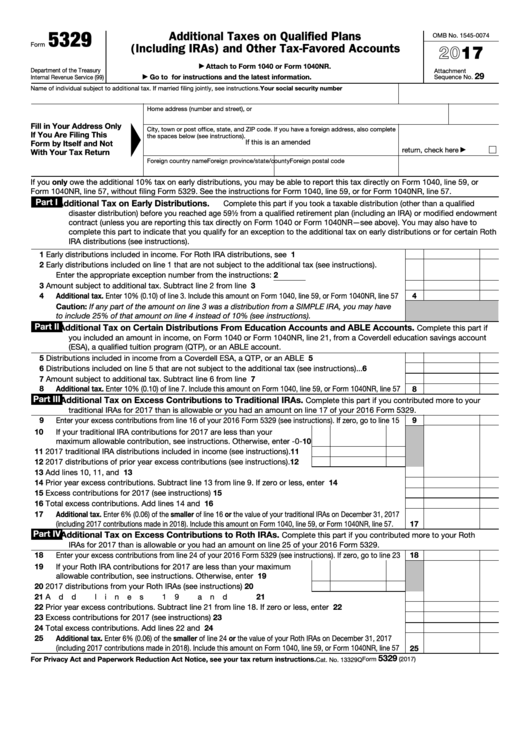

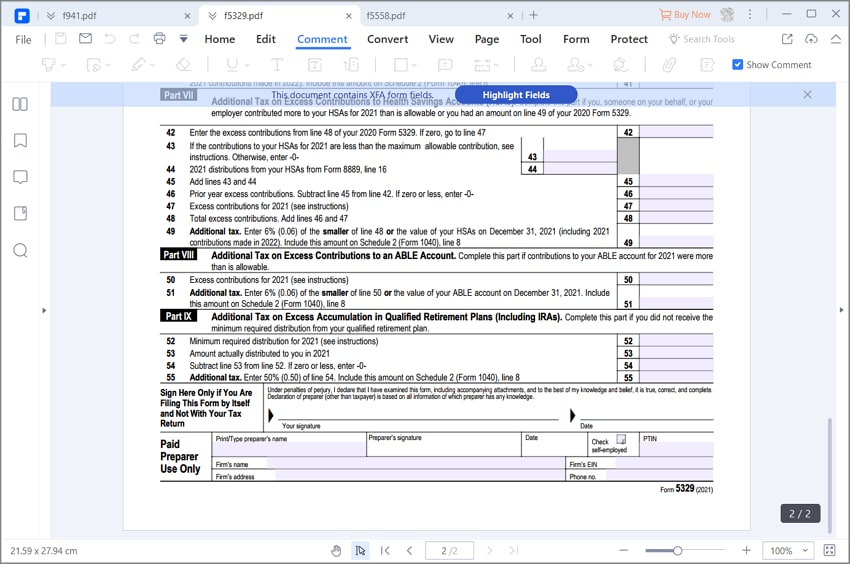

Fillable Form 5329 - Additional Taxes On Qualified Plans (Including

www.formsbank.com

www.formsbank.com 5329 form tax qualified accounts favored iras taxes including additional plans other printable pdf fillable

IRS Form 5329 Download Fillable PDF Or Fill Online Additional Taxes On

www.templateroller.com

www.templateroller.com irs 5329 form tax taxes iras favored accounts qualified including additional plans other templateroller

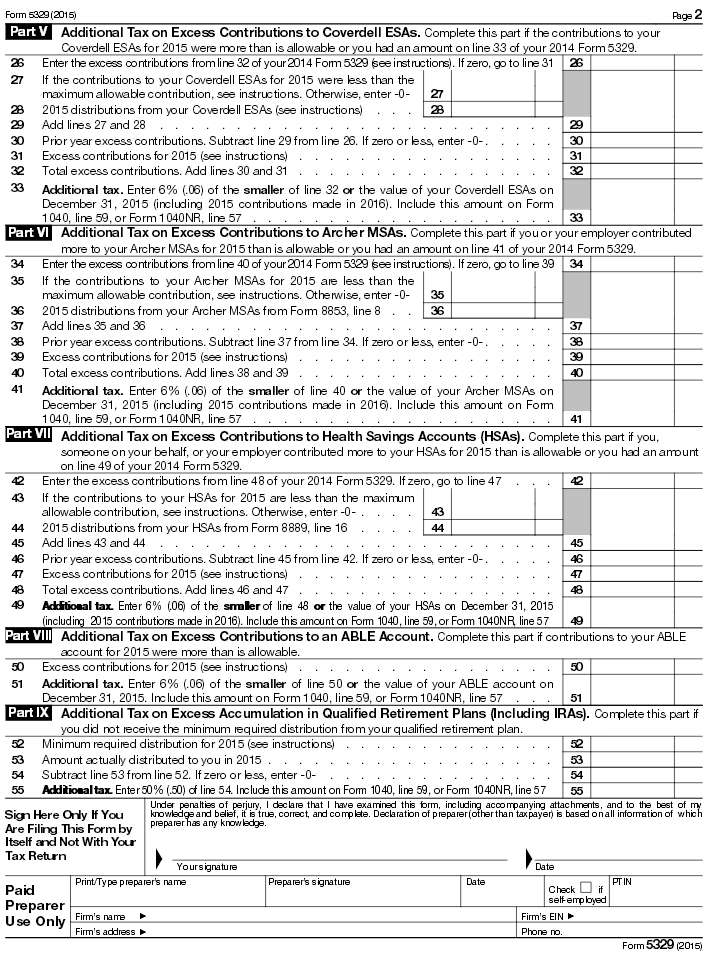

Who Must File The 2015 Form 5329?

www.pension-specialists.com

www.pension-specialists.com 5329 form irs pension hottopics specialists

Form 5329: Instructions & Exception Information For IRS Form 5329

www.communitytax.com

www.communitytax.com irs 5329 withdrawal rmd penalty exception 401k ira waiver missed explanation

Irs Form 5329: Fill Out & Sign Online | DocHub

www.dochub.com

www.dochub.com Fill - Free Fillable Form 5329 2019 Additional Taxes On Qualified Plans

fill.io

fill.io form qualified taxes additional plans fill fillable

How To Fill In IRS Form 5329

pdf.wondershare.com

pdf.wondershare.com 5329 irs wondershare pdfelement

2010 Form IRS 5329 Fill Online, Printable, Fillable, Blank - PDFfiller

5329 form 2010 irs printable pdffiller fill revenue internal 111th congress service 2009 fillable

Instructions For How To Fill In IRS Form 5329

pdf.wondershare.com

pdf.wondershare.com form 5329 irs fill tax part instructions line

How to fill in irs form 5329. 5329 form irs pension hottopics specialists. 5329 irs wondershare pdfelement

0 Response to "sample form 5329 Irs 5329 withdrawal rmd penalty exception 401k ira waiver missed explanation"

Post a Comment